We are here to help our BRITISH customers.

We can provide you with a tax-free voucher that allows you to reclaim the VAT as soon as you embark in Calais, thanks to our partnerships with Global Blue and Skiptax.

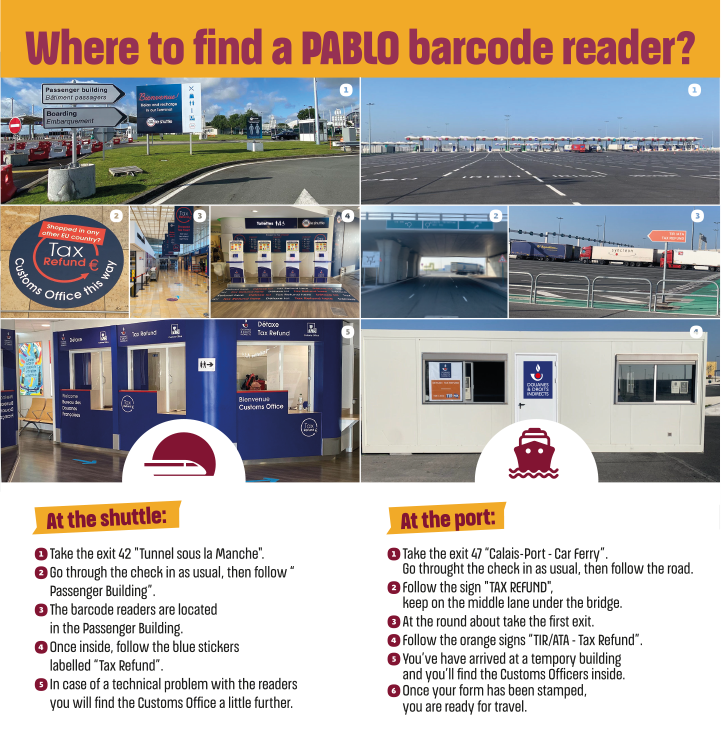

Offering a significant saving of the 15% VAT that can be reclaimed on purchases from our superstores, we forged these partnerships to enable you to reclaim VAT upon boarding at the Eurotunnel and ferry terminals in Calais. By simply scanning a bar code at the kiosks at the Calais port terminals, the refund process is activated.

How does the duty-free refund work when buying wine, Champagne, spirits and beers in Calais?

We have set up a simple back-office system that takes just five minutes to prepare your claim.

French people pay the VAT in France. But you, as British citizens, are going to enjoy your wine, champagne, spirits and beer in the United Kingdom, that is to say outside the European Union. You are therefore entitled to claim back the VAT you paid in France provided you can prove that you are leaving the European Union territory. This is where we come in. We have teamed up with customs to process this for you and joined forces with SkipTax and Global Blue to facilitate the transaction. Amidst the Duty Reform, UK customers encounter a surge in taxes. Uncover strategies to maximize savings with Calais Vins

How to get the refund on VAT

As you would expect, you browse the vast selection of wines, beers and spirits, and pay at the cash desk as usual. And we then take care of providing the tax-free voucher so you can claim the VAT back. We generate this Tax-Free form for you in store covering all of your purchases.

This document certifies what you bought and the amount of VAT you can claim back. This amount will be credited to a payment card within 3-5 days.

The personal allowances for alcohol are set at:

Attention!

If you open and/or consume a product in French or European territory, the tax refund will be cancelled. If you wish to consume a part of the purchase before you board your ferry or Eurotunnel service, please make two transactions with separate payments. We then only produce the tax-free form for the product that you take out of France.

Our FREE TAX partners: